When seeking a car title loan in Fort Worth, understand that lenders typically cap vehicle mileage between 50,000 and 100,000 miles due to increased depreciation for older cars. High-mileage vehicles still hold value, especially with flexible lender policies. To secure the best offers, maintain a thorough service history, practice regular maintenance, and consider refinancing or extending loan terms to manage payments effectively.

“Thinking about securing a loan for your high-mileage car? Understanding car title loan mileage restrictions is crucial before you begin. This guide breaks down the intricacies of these restrictions and how they impact your loan offers. We’ll show you how to assess the value of vehicles with higher mileage, share strategies to navigate these challenges, and help you secure favorable terms despite the constraints. By the end, you’ll be equipped to make informed decisions when borrowing against your car.”

- Understanding Car Title Loan Mileage Restrictions

- Assessing the Value of High-Mileage Vehicles

- Strategies for Securing Favorable Loan Offers Despite High Mileage

Understanding Car Title Loan Mileage Restrictions

When considering a car title loan, understanding mileage restrictions is key. These loans are designed for those needing quick access to emergency funds, often facilitated by Fort Worth loans providers. Lenders typically have specific limits on how many miles a vehicle can have, as this directly impacts the value of the asset. The typical range varies between 50,000 and 100,000 miles, but it’s not uncommon for some lenders to accept higher mileage cars under certain circumstances.

Mileage restrictions exist because, as a car ages and accumulates more miles, its depreciation rate accelerates. Lenders want to ensure the vehicle retains enough value to offset the loan amount in case of default. Therefore, when applying for a car title loan, be prepared to disclose your vehicle’s mileage history accurately. This transparency not only helps lenders assess the risk but also can contribute to a smoother approval process with quick approval times, allowing you to access those emergency funds faster.

Assessing the Value of High-Mileage Vehicles

When assessing a loan offer for a high-mileage car, understanding its value is crucial. Unlike lower-mileage vehicles, which typically hold their resale value better, high-mileage cars may depreciate faster due to their extensive use. However, this doesn’t necessarily mean they are less valuable; it’s more about determining their unique market worth. Several factors influence the assessment, including the car’s make and model, its overall condition, and its service history. A vehicle with a well-documented maintenance record and no major accidents might still command a substantial price despite its mileage.

Car title loan mileage restrictions vary among lenders, but many have flexible policies for high-mileage vehicles. These loans are often sought by individuals looking for quick cash or debt consolidation solutions. The approval process involves a thorough evaluation of the car’s condition and value, with some lenders offering direct deposit of funds once approved. While high-mileage cars might not appeal to traditional buyers as much, they can still be a viable asset for securing loan approvals, providing an alternative means for owners to access immediate financial support.

Strategies for Securing Favorable Loan Offers Despite High Mileage

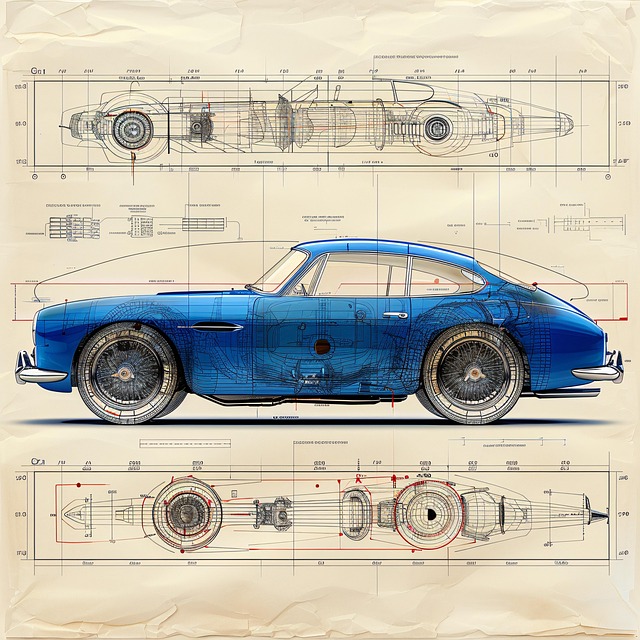

Despite high mileage, there are several strategies to enhance your chances of securing favorable loan offers. One key approach is to maintain a well-documented service history for your vehicle, as this demonstrates responsible ownership and can mitigate concerns about its overall condition. Regular maintenance and timely repairs not only extend the life of your car but also make it more appealing to lenders.

Additionally, exploring options like loan refinancing or extending your existing loan term can be beneficial. A loan extension allows you to spread out payments over a longer period, potentially lowering monthly installments. Similarly, refinancing could result in a lower interest rate, especially if your credit score has improved since the original loan was taken out. These strategies not only make repayments more manageable but also demonstrate your commitment to responsible borrowing, which can positively impact your loan offer.

When considering a car title loan for a high-mileage vehicle, it’s crucial to balance the unique challenges posed by these cars’ history with strategies that can secure favorable loan offers. By understanding car title loan mileage restrictions and assessing the value of your vehicle accurately, you can navigate this process successfully. Remember that while high mileage might be a consideration, it doesn’t have to be a barrier. With the right approach, you can access the funds you need without compromising your financial health.